The Blog

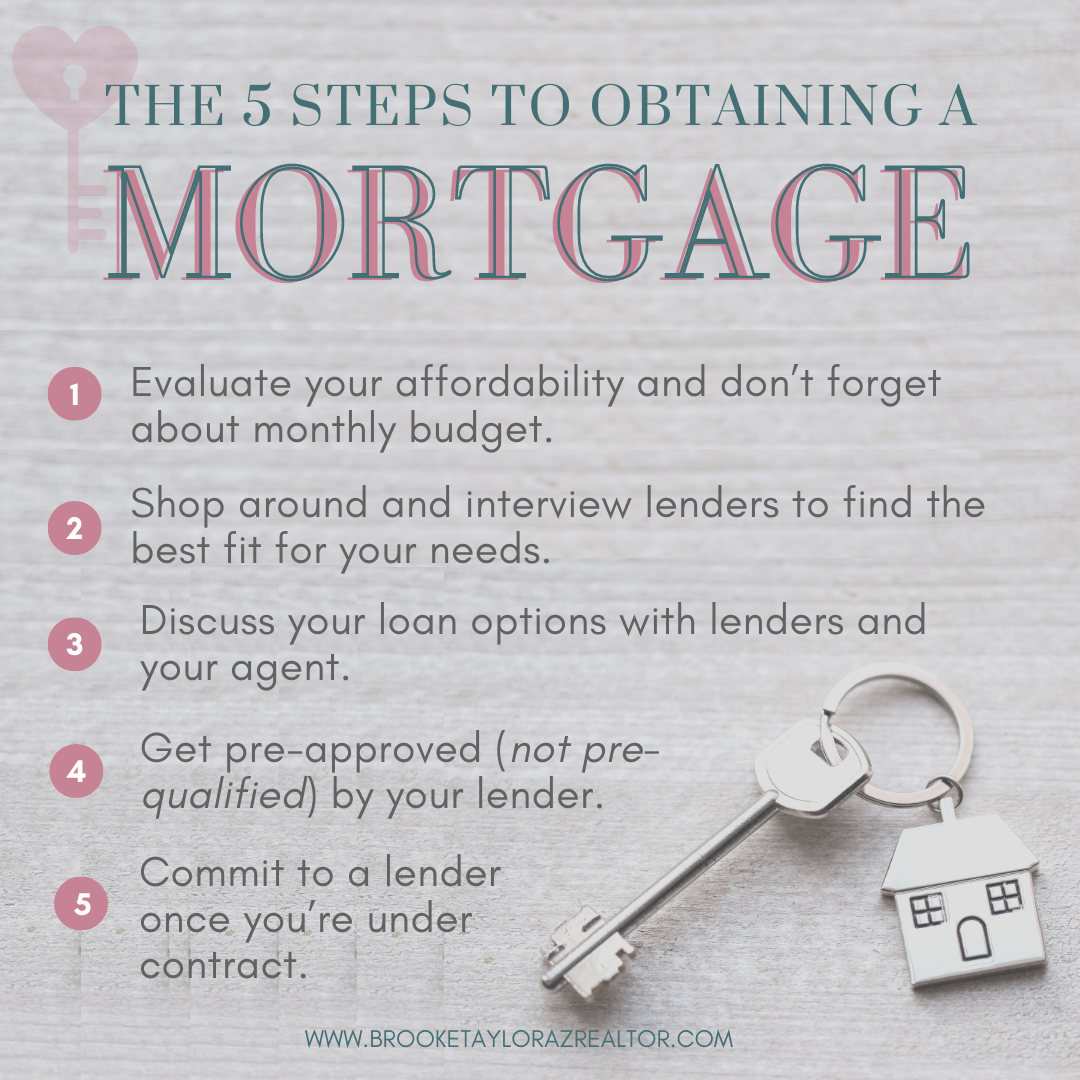

Love Buying a Home series – Week 6 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next […]

continue reading...

Whether you know it or not, there might be things you are doing that can effect your credit score for the worse. Even if you aren’t buying a home anytime soon, you don’t want to be surprised by your credit score when you want to buy a car or refinance, for example. The decisions […]

continue reading...

Love Buying a Home Series – Week 5 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next […]

continue reading...

I believe my job doesn’t end at the settlement table, and I want to be your resource for all things real estate related even after you move into your home. Below are the questions asked most by past clients who have bought a home with me. I hope the answers to these questions help you […]

continue reading...

Love Buying a Home Series – Week 4 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next […]

continue reading...

At first thought, it may seem logical to take any extra money you might have (thank you work bonus!) and pay down your mortgage. Seems like a good idea on the surface, but let’s dive deeper and see if it’s right for YOU. Tackling mortgage debt on the fast track is not highly recommended unless […]

continue reading...

Love Buying a Home – Week 3 My step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and even to maintaining your home after you’re all moved in. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune […]

continue reading...

Are you giving your credit score the attention it deserves? If you’re even thinking about buying a home or refinancing your current one in the near future, then you need to show it some love. Make sure you understand the ins and outs of your score and what you can do to make it more […]

continue reading...

Love Buying a Home Series This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and even to maintaining your home after you’re all moved in. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for […]

continue reading...

As a homeowner, you should have gained some equity in your home since living there and paying your mortgage down. Have you ever considered using this equity to finance some of your needs if you don’t have the cash flow? A home equity loan or line of credit are two ways to get the necessary […]

continue reading...

Hi, I'm Brooke Taylor and I love to help first-time home buyers and sellers in Arizona!

Need a new space, but don't know where to start?

Not sure if you can save for a downpayment?

Feeling like your first home has to be your "forever home?"

Well, you're in the right place!

Being a first-timer doesn't have to be scary or stressful. (And you don't even have to give up your coffee or avocado toast!)

I help first-time homebuyers and first time sellers make their real-estate goals a reality.

Whatever your situation, if your current living situation is just not working for you anymore, let's chat.

Schedule a free consultation now!