How To Be The Best Homeowner… Like Ever

Did an interest rate catch your attention the last time you were looking online? Maybe you’ve been thinking about buying a home, buying an investment property, refinancing, or getting a line of credit. However, it’s very rare that the interest rate you see online will be the one you get from a lender. There are […]

continue reading...

When you bought your home, you might have had to get Private Mortgage Insurance (PMI). If so, you might have been paying it for a while and it could be time to petition your lender to stop this payment requirement. For a quick recap — PMI is insurance that protects the lender in case […]

continue reading...

Everyone wants to avoid these three biggies: Roof Damage Water Damage Fire Damage Don’t worry, there are plenty of things you can do to prevent these blunders. Here’s a rundown of the simple steps you can take to keep your home in tiptop shape – what to look out for, how to prevent a problem, […]

continue reading...

I get this question from both new clients who are about to buy their first home as well as clients that have owned their home for a while, “How long should I plan to hold on to my home before I sell?” Whether you want to make a quick profit from the rising real estate […]

continue reading...

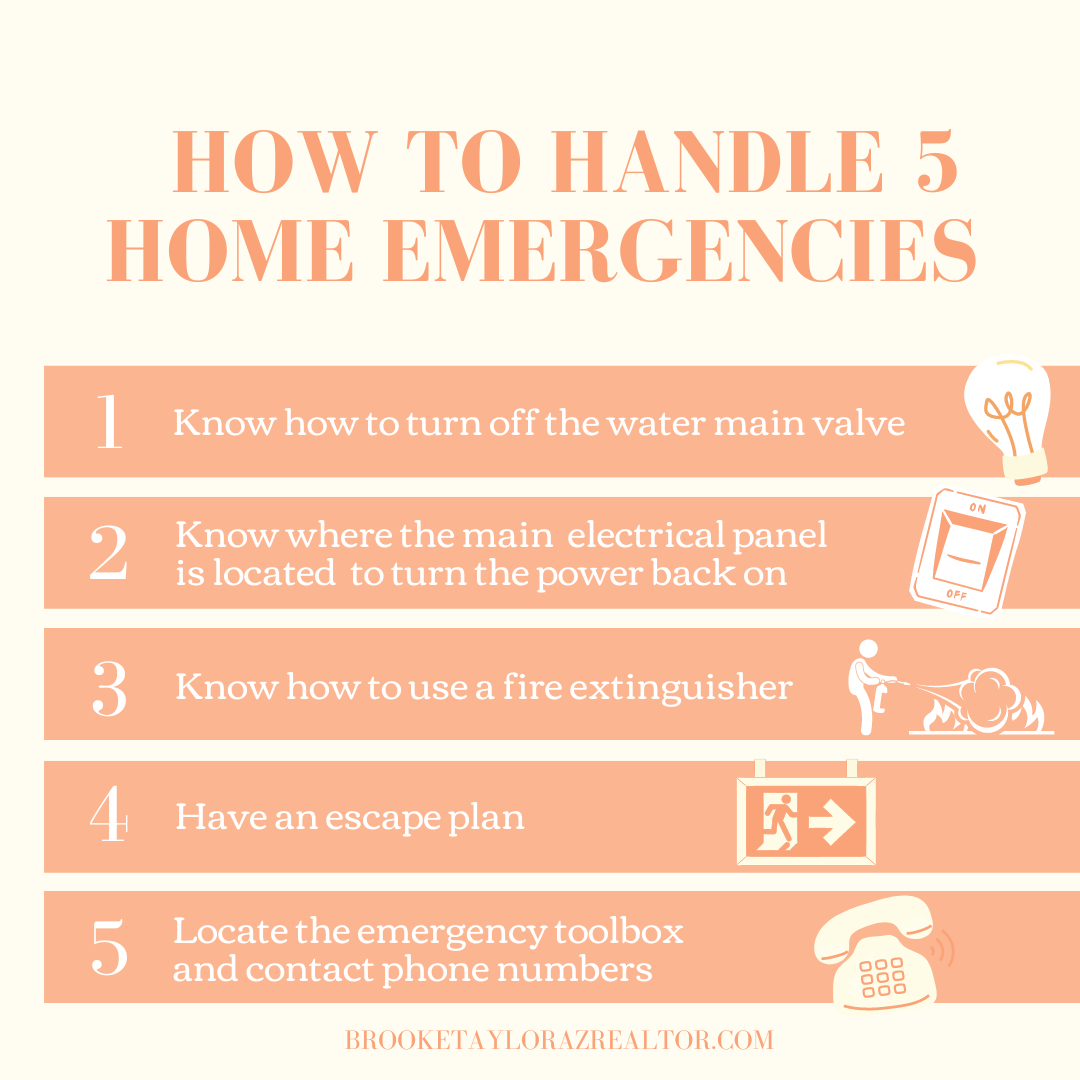

As a homeowner, it’s fun to enjoy all the great things about your home—place to relax, entertain, or spend quality time with family. But what about when something goes wrong? Do you know what needs to be done in case of an emergency or other urgent situation in your home? Here are 5 […]

continue reading...

Should’ve, would’ve, could’ve. Don’t make that your mantra when it comes to your home’s maintenance! Preventative maintenance is worth your time and money NOW to avoid costly home disasters later. You don’t want to be the one saying, “I should’ve caulked those windows for a few bucks a tube,” when faced with a $2,000 repair […]

continue reading...

Being a homeowner can be exciting and fun at times, with lots of freedom to make it your own space! As a homeowner, though, you’re the one in charge of any repairs, maintenance, finances, and improvements over the long haul. Whether you’re a first time homeowner or you’ve owned many, it’s important to stay informed […]

continue reading...

Whether you know it or not, there might be things you are doing that can effect your credit score for the worse. Even if you aren’t buying a home anytime soon, you don’t want to be surprised by your credit score when you want to buy a car or refinance, for example. The decisions […]

continue reading...

I believe my job doesn’t end at the settlement table, and I want to be your resource for all things real estate related even after you move into your home. Below are the questions asked most by past clients who have bought a home with me. I hope the answers to these questions help you […]

continue reading...

At first thought, it may seem logical to take any extra money you might have (thank you work bonus!) and pay down your mortgage. Seems like a good idea on the surface, but let’s dive deeper and see if it’s right for YOU. Tackling mortgage debt on the fast track is not highly recommended unless […]

continue reading...

Hi, I'm Brooke Taylor and I love to help first-time home buyers and sellers in Arizona!

Need a new space, but don't know where to start?

Not sure if you can save for a downpayment?

Feeling like your first home has to be your "forever home?"

Well, you're in the right place!

Being a first-timer doesn't have to be scary or stressful. (And you don't even have to give up your coffee or avocado toast!)

I help first-time homebuyers and first time sellers make their real-estate goals a reality.

Whatever your situation, if your current living situation is just not working for you anymore, let's chat.

Schedule a free consultation now!